There’s fierce competition in China’s banking sector. So how can brands stand out? Why is bank marketing important?

China’s economy and banking sector

On November 30th, 2022, the Bank of China Research Institute released its 2023 Economic and Financial Outlook Report. It concluded that in 2023, uncertainties in the global banking industry will persist and profitability will weaken. Domestically, the government aims to ensure continuity and stability with macro policies to “stabilize growth, promote recovery, prevent risk and ensure safety”. The government’s goal for 2023 is to improve confidence and boost economic growth drivers.

An April 2023 article from Deloitte noted that in 2022, commercial banks in China improved profitability, achieving net profit of 2.3 trillion RMB, a 5.4% year-on-year rise. It also noted that banks have increased and improved credit services and asset quality, reduced their ratios of non-performing loans and increased liquidity and risk control.

How has Covid affected banking and new competitors?

Because of Covid and other geo-political events, financial markets continue to be unstable and won’t regain stability in the short term. There are also significant challenges to the resilience of commercial banks’ global operations. Disruptions to global supply chains have also accelerated the reshoring of manufacturing facilities to other locations.

Emerging competitors are seizing opportunities, especially when it comes to customers who are more accustomed to using financial services on digital platforms. These new competitors are providing customers with a superior experience at a lower cost, posing a significant challenge to existing financial institutions. They include fintech startups and companies specializing in tech finance.

However, traditional financial institutions in a country with such a high usage rate for digital payment are rapidly undergoing digital transformation. They’re addressing technology, business and people issues, but are still hampered by traditional structures and operating models. Digital competitors have some advantage but all players are trying to find the right mix of digital and human interactions for their customers.

The government has made expanding domestic demand one of the priorities for 2023. In terms of expanding investment, policy-oriented development financial tools are likely to be used such as increasing support for key infrastructure. In promoting consumption, the banking sector is likely to focus on housing and transportation, new energy vehicles and wealth-building financial products. Consumer credit might be further increased to support those in a position to upgrade their consumption.

Why should banks invest in WeChat content for China?

WeChat is one of China’s main super apps that is used for all kinds of things including messaging friends, posting photos, paying bills, daily shopping and buying tickets. It also has incredible reach within the country with around 811 million users in 2022. If brands want to reach their customers easily and conveniently, they need to have a WeChat account. Banks can provide a full range of services on WeChat such as the ability to make bookings for offline services through the WeChat public platform. It acts as a banking service platform integrating marketing, financial transactions and customer service.

WeChat Pay also links to user’s bank accounts, making payments easy. With Tencent being asked in 2022 to put WeChat Pay into its financial holding company, this may change in the future.

The banks that do well on WeChat

1 Agricultural Bank of China

The Agricultural Bank of China’s WeChat account is comprehensive. It includes financial news, knowledge sharing, promotions during special occasions and allows the bank to connect with users in various ways.

Their posts are enriched with hand-drawn images that are in line with modern online presentation and reading styles.

Screenshots from the Agricultural Bank of China’s WeChat account.

They published a series of posts on key finance-related holidays like World Consumer Rights Day.

Screenshots from the Agricultural Bank of China’s WeChat account.

They published posters for holiday-related content as the special days approached.

Screenshots from the Agricultural Bank of China’s WeChat account.

2 China Merchants Bank

China Merchants Bank regularly publishes content related to a number of topics. The overall style is consistent and youthful. The core of their target audience is office workers. China Merchants Bank’s WeChat’s content fits its target audience well.

They’ve cultivated a wide range of topics and publish regularly.

Screenshots from the China Merchants Bank’s WeChat account

They usually developed creative, novel, youthful designs, which could attract young consumers.

Screenshots from the China Merchants Bank’s WeChat account

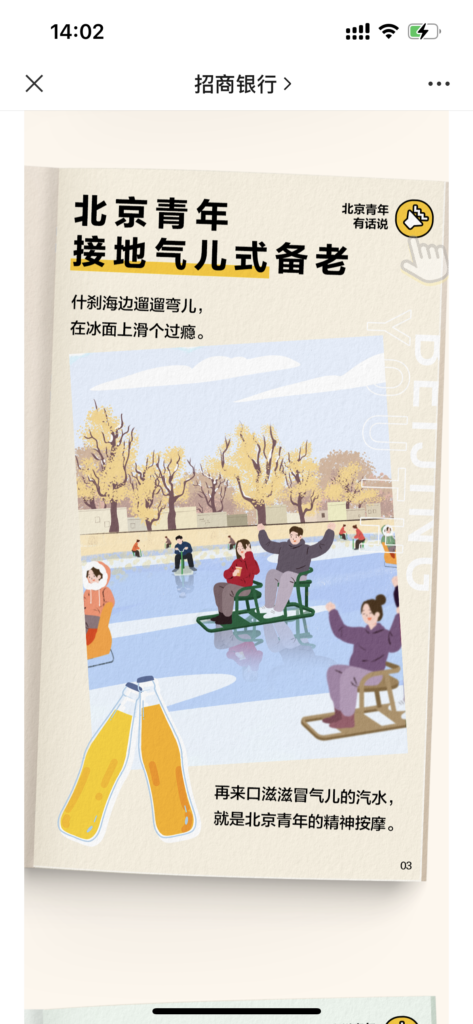

They published content on topics that will be of interest to the bank’s core audience.

Screenshots from the China Merchants Bank’s WeChat account

Key Steps for Bank Marketing on WeChat

Let’s take a look at some key steps for banks when managing WeChat accounts.

Step 1 Know your brand and the image it should portray

Different commercial banks have different target audiences, and understanding your bank’s positioning enables you to develop a more targeted content plan that will help increase your reach and connection with users on different platforms.

For example, Agricultural Bank of China has customers in urban and rural areas, industry and agriculture, and employees and business owners so it provides services for urban and rural residents, and its account image shows this down to earth, relatable image.

China Merchants Bank, on the other hand, is renewing its brand identity and focusing on the needs of young users, so its WeChat content often appeals to workers or college students. Therefore, topics such as jobs, college and others are more popular.

Step 2 Make a social media calendar

Account operators should develop a marketing calendar for the following month or months in advance with some flexibility to allow posts related to unfolding current events or sudden policy changes. It’s best to work one month in advance to prepare content and work around big occasions like holidays, festivals and key dates in the bank’s year and in the financial year.

For example, in March, there were important festivals such as Women’s Day, Consumer Rights Day and the spring equinox so lots of banks posted content related to these special days to interact with users.

Step 3 Attract Chinese consumers with high interest topics

Financial topics are very interesting to Chinese netizens. Find out which financial topics are the most important to your target audience, current customers and your WeChat account followers and give them useful information. For example, here are some popular topics for banking marketers to explore:

Bank interest rate hikes/reductions

Benchmark interest rates for loans

Central bank policy changes

Inflation and employment stats

Wealth preservation tips

Exchange rates

Changes in official bank forms

China’s private pension scheme

ESG development status

Key industry development analysis

Small and medium-sized enterprise development

So, now that you’ve analyzed your audience and chosen a topic, how can you attract the reader’s attention? The most interesting WeChat content combines graphics and text to produce something visually appealing.

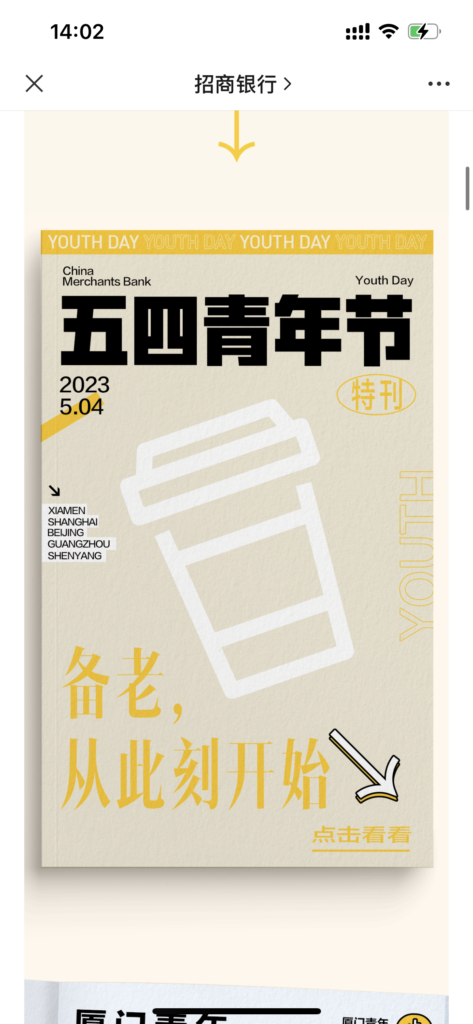

Screenshot from China Merchants Bank’ WeChat article – How today’s youth prepare for aging

Take China Merchants Bank’s WeChat post about pensions as an example. It combines youthful creativity, colorful, evocative images and brief, clear text. The images depict different retirement styles in different cities and the bank’s retirement products are introduced at the end. The article performed well and received 83,000 views and nearly 500 interactions.

Step 4 Use the end of WeChat articles to deliver ongoing messages

Banks can integrate important information at the end of each article to call on consumers to take the next step, such as following the WeChat account or learning more about banking services.

You can include:

- QR codes: QR codes for the bank’s main WeChat account, for a special promotion or linking the reader to an application form should be included at the end to make it easier for the reader to take the next step. QR codes can be made into pictures or other unique format. The text should feature an appropriate call to action.

- Other bank platform logos and links: You can add a bar with hyperlinked logos so that readers can click to other platforms for more information. This helps to integrate followers from different platforms to get greater visibility or influence.

- Other functional buttons: WeChat articles support buttons with external links making it easier for readers to go to other sites, apps or special pages. Hyperlinked buttons to the bank’s official website, a map, special landing pages or the bank’s mini program can be added.

Step 5 Leverage mini programs as an important marketing channel

Online reservations and bill inquiries have become an important way for banks to connect with customers and streamline their business processes. Mini programs can be used to do this. They can also be used for other things like quizzes, gamified financial education and more. They’re a key feature in WeChat with a huge number of users who can reach them easily.

Screenshot from Standard Chartered Bank’s mini program

For example, Standard Chartered Bank’s mini program includes a series of guides about transferring money, doing telebanking, registering online and more. This provides users with integrated guidance information. You can also add basic services such as online appointment booking and bank address or map searches to the mini program.

Conclusion

WeChat marketing for banks requires creative ideas, professional design, experienced post production, and more. Seeking help from a professional team can make your WeChat account management easier and clearer.

If you want to use your content to expand your brand’s reach and achieve your marketing goals, contact Alarice to help you better position your brand and plan creative brand campaigns and we’ll create a professional, tailored solution for you.

Sources:

https://www.boc.cn/en/bocinfo/bi1/202212/t20221229_22333731.html