Many things have changed in the last year, with new regulations, standards, and consumer demands steadily reshaping China e-commerce and China’s digital world in 2022. Not to mention the sudden shift earlier this year in opening up and removing several COVID-related restrictions. Indeed, the reopening has sparked hopes for a broader economic recovery. Traders are already forecasting a surge in demand for China tech stocks, which have risen $700 billion since their low in October 2021. Gains for China’s benchmark CSI 300 index on Monday lifted it more than 20% above its most recent bottom, meeting the technical definition of a bull market.

Following the success of ChoZan‘s mega report series, their 650+ page research on China E-Commerce, Marketing, and Digital Space, 2023 is finally out! This study was created by Ashley Dudarenok and her ChoZan marketing team with input from more than 50 China experts to provide marketers and China watchers with the most recent information on China’s digital arena.

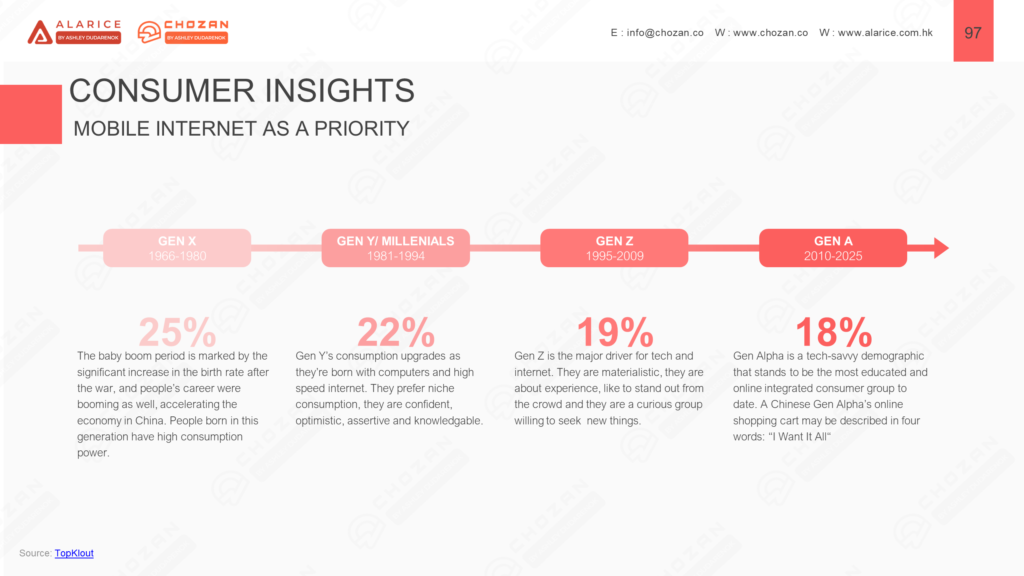

Insights on Major and Emerging Consumer Groups

China has numerous diverse consumer groups, with some analysts suggesting that Chinese customers are among the most sophisticated and demanding in the world. This report makes sure to develop detailed profiles of nine major key consumer groups, which are:

- Millennials

- Gen Z

- The Silver-Haired Generation

- Chinese Men

- Female Internet Users

- Super Parents

- Pet Owners

- Young Lower-Tier City Dwellers

- Happy Singles

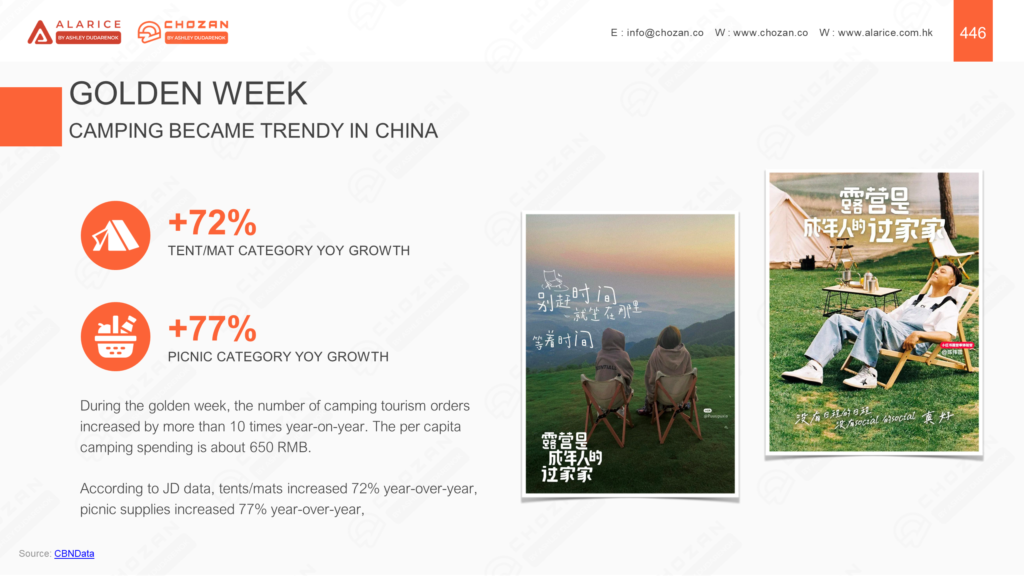

The report also has information on five emerging consumer groups that are gaining more power in the second half of 2021. The five emerging consumer groups are: Green Consumers, Coffee Lovers, Sports Devotees, Camping Enthusiasts and Smart Home Appliances Consumers.

Major Consumption Economies Analysis

Consumption economies form when a trend becomes very profitable, brings in more customers, and is backed by big players in e-commerce, government regulation, and building infrastructure.

This report focuses on twenty economies including, The Coffee Economy, The Camping Economy, The Medical Beauty Economy, The Home Economy, The She Economy, etc.

Major Online Shopping Festivals

China Internet Watch has estimated China’s online retail sales totaled 13,785.3 billion yuan in 2022, up 4.0% from the previous year. If brands wish to flourish in this market, they must be aware of the main online shopping festivals in China.

ChoZan has provided extensive summaries of seven major e-commerce festivals in this report. These seven festivals are Chinese New Year, Women’s Day, Chinese Valentine’s Day, 618, Golden Week, Double 11 and Double 12.

Development of Major E-Commerce Platforms

According to GlobalData, the Chinese e-commerce business is predicted to reach $3.3 trillion (CN13.8 trillion) by 2025. Even though the number of things Chinese people buy online is growing quickly, they need shopping platforms they can trust and that are easy to use. There are marketplaces where consumers can find verified brand stores and do all of their shopping in one place. It is essential for brands to be involved in such marketplaces to gain exposure and demonstrate legitimacy.

This report will give you more details about the information above and also show you more insights into six important e-commerce platforms, Alibaba, JD, Pinduoduo, Douyin, WeChat and Kuaishou.

Updates on China’s Social Media Platforms

The report will also show you the most recent features of various social media networks. An overview and extensive information on the various platforms, as well as the development of mini-programs from platforms such as WeChat, AliPay, and Baidu, will be provided.

For your convenience, there will be comments from China marketing experts on the issues listed above.

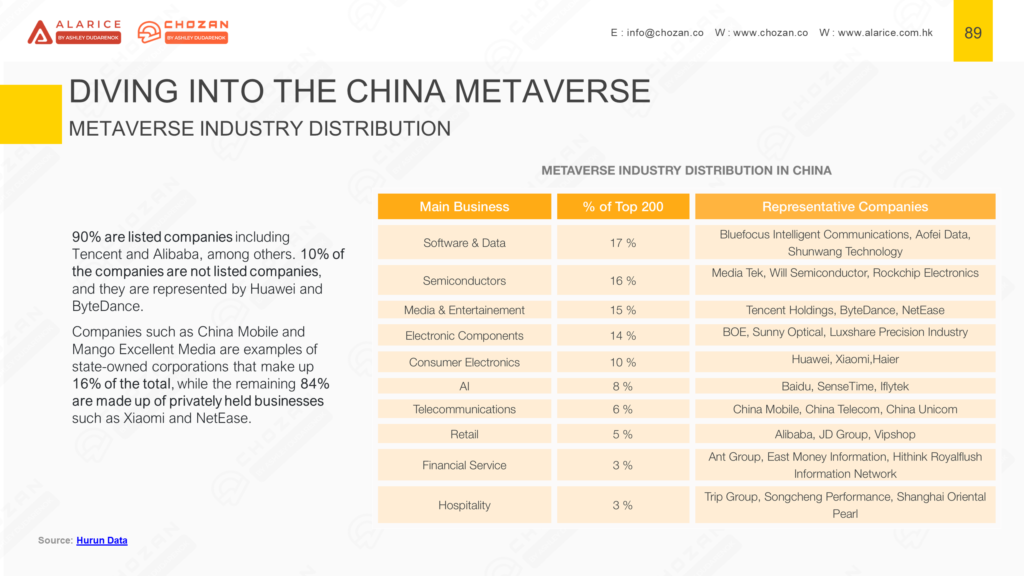

China’s MetaWave

According to Morgan Stanley’s analysis, the market for the metaverse business in China is estimated to be worth $8 trillion. By 2025, 37 million Chinese people who use the Internet are expected to have a virtual identity on Metaverse platforms.

500+ metaverse-related companies in China were given names inspired by the Metaverse and by 2021, 93% of them had been registered.

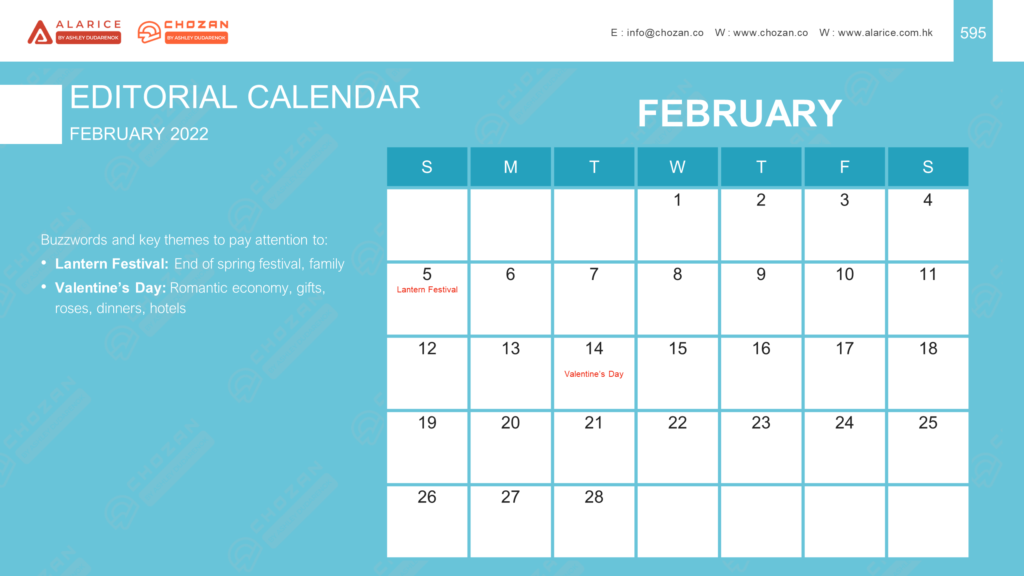

A Marketing Calendar for 2023

ChoZan understands the importance of having a China marketing calendar in place to help your brand advertise well in China. Outlining your monthly marketing efforts can provide consistent advertising for your business, allowing you to attract new customers and retain existing ones.

In the report’s China Marketing Calendar, ChoZan has highlighted important events that can be used for promotions, such as Qixi and Children’s Day, and holidays, such as the Mid-Autumn Festival and China’s National Day.

KOL Insights

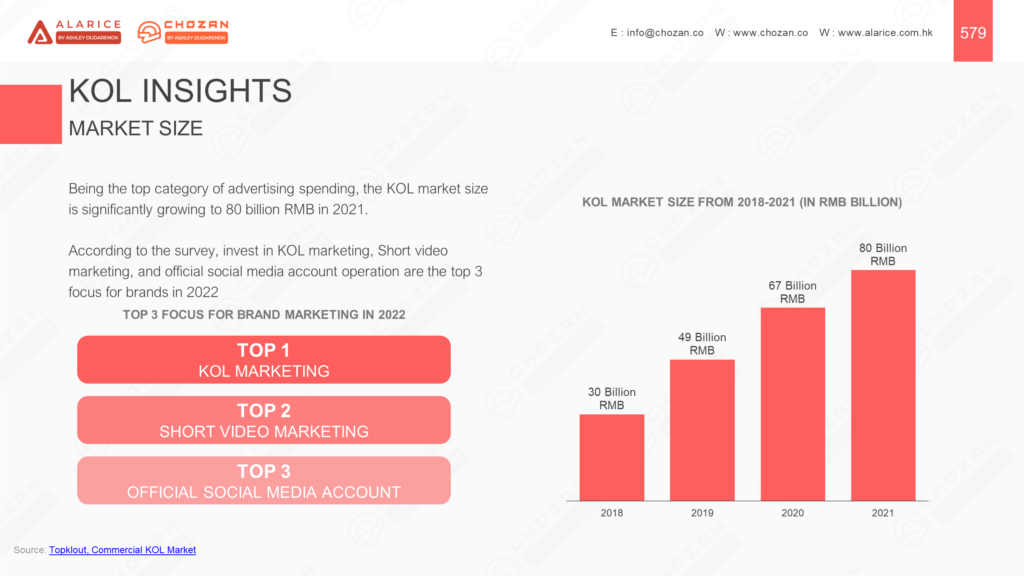

There is little doubt that KOLs’ influence over consumer consumption in China is growing stronger over time. KOLs have risen to the top of the advertising spending pyramid, causing the KOL market to expand considerably.

A lot of brands invest significantly in KOL marketing to advertise their products on live streams. KOLs also use more than one platform, which gives them more exposure to people who might buy their products.

In addition to Ashley and her team’s insights, they’ve also talked to more than 50 experts, including TV commentators, a team of China’s tech giants, China agency owners, university professors, and famous book authors. They’ve done this to ensure that the report is comprehensive and can truly reflect China watchers’ collective wisdom. Download the informative mega guide and if you have any China-related questions, please don’t hesitate to contact us.