China’s FMCG market is characterized by dynamic brand building through digital advertising. The market is competitive and has become increasingly so in recent years. With the changing FMCG landscape, it is very important for brands to stay on top of the crowd. Before the pandemic began, FMCG brands enjoyed a five-year run of premiumization but have become cautious again. More and more consumers have started to opt for cheaper versions of household and personal care products or buy them in bulk. As of April 22, the FMCG volume grew by 5.6% compared to April 2021, marking consumers’ price sensitivity.

While gaining a foothold in China is difficult and risky, we still see a lot of foreign brands trying to enter the Chinese market. Starting as exporters and then moving up to retailers themselves, they have filled up the market with their stock. Covid-19’s shadow still follows the FMCG market today, but while most FMCG companies acknowledge that for the rest of 2022, the market will probably likely be volatile and on a downward trajectory, they are solidly looking forward. So, how can brands continuously appeal to the changing FMCG landscape, its consumers, channels, and market realities? Read on to find out:

FMCG product categories

There are five categories of FMCG products. They are personal care products, home or household care products, food & beverages, alcohol and cigarettes, and OTC medicines. Food and beverages account for 19% of the sector, while healthcare is 31%, and the rest (household and personal care) share the remaining 50%. Personal care products include items that you use for your body externally, such as shampoos, soap, cosmetics, oral care items, or baby care. Household care products are home maintenance products (dishwashing, fabric detergents, cleaners, insecticides, or bathroom cleaning supplies). Food and beverages are pretty much what it says with the exclusion of alcohol and cigarettes, which belong in their own category. Finally, OTC products are generally those that are available in drugstores or medical shops that a person can buy without a doctor’s prescription. They include pain balms, herbal cough remedies, or throat lozenges.

These products are what you typically see on shelves when you go for a grocery run, and they are further divided into three segments: durable goods, non-durable goods, and services. All those that have a shelf life of three years or more are considered to be durable goods, and those less than three years are non-durable goods. While the average selling prices for FMCG products gained only 3% in 2021, the past year still experienced a modest post-Covid 19 recovery, with the total FMCG volume gaining 3.3% and value rising by 3.6% across the board.

Top 4 FMCG Consumer Trends in China

- Rising Middle-Class Consumption

- China’s middle-class growth is well documented, and its sheer scale continues to astound the business world. In 2000, China’s middle class was just a mere 3% of the population, but in the last decade, it now constituted over 707 million people with a spending power of $10,410 in 2019. By 2022, it is expected that the middle class’s consumer spending and services will be valued at 3.4 trillion USD, which is 24% of the GDP of China. This class is more willing to spend on quality, premium products that have a high level of trust and brand awareness and can afford to spend more on these products as opposed to only the basic necessities. The Chinese middle-class consumers are, and can, punch well above their weight.

- Look towards Lower Tier Cities

- About 90% of Chinese consumer growth is expected to come from cities as they urbanize. Of this, the lower tier cities are continuously gaining ground as they constitute 45% of total household consumption. These people have considerable purchasing power (80% more on a per capita basis compared to the national average). In Guiyang, for example, household consumption has doubled. Domestic travel has also contributed to the continued success of lower-tier cities as domestic tourism adds to the revenues of the cities. In light of the increasing spending power of the middle-class Chinese, lower-tier cities’ tourism sector can only increase.

- Domestic preferences: Guochao

Source: weibo official account of Coconut Palm & Wanglaoji

- Guochao is the desire to buy local Chinese goods and services to support the local industry. This attitude towards products has been increasingly patronized over the years, and led to the emergence of local players in some categories. Baidu searches for Chinese brands have jumped from 38% to 70% in the last decade. Leading this wave are the millennials with their idea of “going back” to their roots and being proud of it. Famous FMCG brands influenced by Guochao are White Rabbit Candies, Wanglaoji, and Coconut Palm as they capitalize on the nostalgia of younger consumers. Tmall, JD.com, and other platforms have also explored and expanded the Guochao market. They included an exclusive page on their platform that highlights Guochao products.

Source: weibo official account of Tmall & JD

- Digital All the Way

Source: Weibo official account of Tmall & JD

- With China’s reliance on the Internet, it comes as to no surprise that they are increasing their data consumption with each year. E-commerce platforms, digital payments, healthcare, and other services rely on data shared by consumers, and led to the rise of super apps. The younger Chinese market have enthusiastically patronized this shift in their daily lives, owing to the fact that most of them are digital natives. Aside from younger consumers, even seniors and the aged population are increasingly dependent on digitalization. 11% of China’s total internet population in December 2020 are seniors, a major jump from the 6% in March 2020. It is estimated that at least two-thirds of the total senior Chinese population will be online in one form or another by 2030, 13.9% of the total Chinese population today. FMCG brands can use big data to improve their supply chain, transport, warehouse operations, product price points, and customer personalization. These factors increase a brand’s likability and patronage.

FMCG Marketing in 2022

- Use micro-influencers (influencer marketing)

- One of the most effective ways to touch base with a Chinese consumer market is to use influencer marketing. There are different kinds of influencers in the Chinese landscape, but FMCG brands (especially smaller ones) can benefit with micro-influencers. They are more affordable than macro-influencers, or those that are otherwise well-known. Micro-influencers are good for niche markets, and can increase trust between your brand and the consumers. They also rake in higher engagement and conversion for your product.

- Nurture relationships with your original customers

Source: zhihu

- Repeat customers are an FMCG brand’s most vital point regarding its growth. This is why it is crucial to nurture a brand’s relationship and establish a tight-knit community with its consumers. Repeat customers are easier to retain than newer ones and are less costly than newer customers. This is because a brand needs to invest its budget in advertising and other promotions to woo newer customers successfully, but repeat customers already know the strong points of your brand and tend to go back for more. Therefore, a strong CRM and tight-knit community help establish and nurture your relationship with your consumers. Also, implementing CRM these days is more effortless. Often, shop assistants have to provide a 1-1 service to major customers through WeChat private messages and groups, but today, several channels automate it without sacrificing personalization. This newer software and private groups can make customer service easier while at the same time retaining personalization at a bigger scale than a shop assistant can provide. This method is driving increased sales for Chinese domestic FMCG brands.

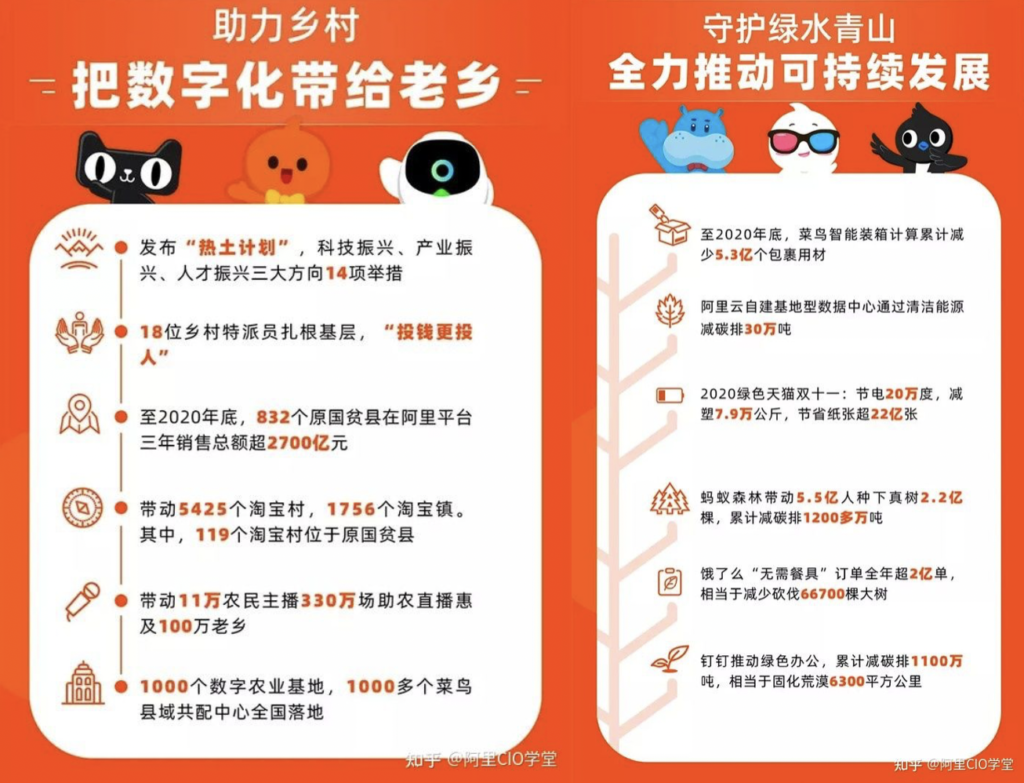

- Win consumers with CSR programs

- Chinese consumers like brands that have a “conscience” or responsibility to their audience. CSR programs can give FMCG brands a platform to give back to the community and show their customers that they have a values-based approach to their business. It is ultimately good PR, which can help your brand because today’s consumers investigate the brands that they are buying. Social issues and business values affect buying decisions of consumers. Examples of large FMCG companies with good CSR programs are Unilever and Sidomuncul.

Source: weibo official account of Unilever

- Get in on the creativity: filter-making

- FMCG companies can ride the AR wave by creating and promoting a filter-making program or competition with their consumers. Various platforms offer ways to create a filter and have it shared on consumers’ own social media accounts. For example, Instagram’s Spark AR studio allows people to create filters, and brands can hijack this trend to promote their campaigns or specific products.

Source: JD

- Let consumers peek into day-to-day operations

- The importance of customer trust for FMCG brands cannot be downplayed. One way to foster it is to be honest with consumers by letting them peek into the day-to-day lives of the people in the brand. Following and recording the daily activities of an employee in your brand is a good start to do so. This humanizes your brand and fosters brand trust and loyalty. L’Oreal have used this strategy with their #LifeAtLoreal campaign which went viral. Increasing the credibility of their team members and products with this move, they showed that consumers don’t have to think twice about their product.

- What’s new this 2022?

- Convenience trumps all

- With the unexpected restrictions and lockdowns brought by the pandemic, access to basic goods is often disrupted or unavailable. The rise of food deliveries or deliveries as a whole has to do with convenience. As consumers and their families get increasingly busier with the return to a “new” normal, there is a heightened need for convenience for FMCG products as well. Even supermarkets have grocery delivery systems to make it easier and more attractive to consumers that buy from them. FMCG goods that benefit from this are the instant-ready ones, such as “TV dinners”, microwaveable goods, or all-in-one meal replacements like nutribars or powdered meal drinks.

- Consumer preference: Healthy options

- Another attractive point for consumers is the “healthier” options that brands present. Low-sodium, reduced fat, sugar-free products are increasingly popular, and the health FMCG industry continues to proliferate with plant-based milk alternatives, lab-grown “cultured meat”, or alcohol-free mocktails to gain wider acceptance with consumers. On a happier note, allergen-free products are also becoming more popular with consumers. Perceived health benefits for FMCG products make them stand out to consumers.

- Environmentally aware

- More and more Chinese consumers are being environmentally conscious with their purchases and would often eschew plastic packaging in favor of carton or paper-based ones. Products labeled as “organic” and “local” find more ground with consumers than traditional FMCG food and beverage products. Those who buy meat, dairy, or poultry also prefer products with labels that are “antibiotic-free”, “grass-fed”, or “free range” compared to traditional ones. Additionally, plastic-free packaging is more attractive to Chinese consumers than non-sustainable packaging.

- Convenience trumps all

- Give customers an experience

- Younger Chinese consumers are increasingly interested in brand experiences than the actual products themselves. Aside from just straight out buying products, these consumers like to experience the product and brand itself, such as Coca-Cola’s personalized name bottles, or giving them a memorable and exciting experience, like creating adventurous (or spicy) flavors. These strategies help create a buzz around an FMCG product and are more likely to be referred to their peers for a similar experience.

- Leverage technology

Source: Sohu

- FMCG brands can benefit from using virtual reality, AI, and augmented reality in advertising their brands. This is easy to integrate with smartphones, which everybody has these days. Brands can enhance their customer’s experience and engagement with their products when they use virtual reality or AI. Additionally, augmented reality can also help in “trying” out the products for consumers and make it more likely for them to patronize the product.

Conclusion

With the changing FMCG landscape in China, brands can easily be left behind if they cannot adapt quickly to market changes. FMCG products are especially dynamic, so they need to be accurately tracked, molded, and studied to have the most efficient strategies for selling FMCG goods.

Alarice can help you prepare for the ever-changing FMCG landscape while it’s still in its early stages. If you need marketing research and strategy in China, China trend-watching or more, feel free to contact us. We’re here to help.

You can also check out our bi-weekly newsletter to get insights about the Chinese digital media, market, e-commerce platforms, and more!