If there’s one thing the year 2020 has taught us, it’s the fact that the future is much more unpredictable than ever. Last year has undoubtedly been a roller coaster ride and brought drastic changes to our everyday lives. Just looking back, it’s not hard to see how far the Chinese digital marketing and consumers have evolved over the year 2020.

Following the success of the previous Q4 2020 report, China expert Ashley Galina Dudarenok and her ChoZan team have returned with their comprehensive 600+ pages China report: ChoZan Mega Report China E-commerce + Marketing Q1 2021 Outlook to equip marketers and leaders on the latest market and consumers information in China as well as highly actionable marketing insights. The mega report covers the following topics in great details and is updated with the latest information and data from Q4 2020.

- China’s digital landscape

- 9 key consumer groups: millennials, Gen Z, the silver-haired generation, Chinese men aged 40+, power women, super mum and dads, China’s pet lovers, lower tier city youth, happy singles

- 4 e-commerce platforms: Alibaba, JD, Pinduoduo, Kuaishou

- 3 mega shopping festivals: CNY, 618, Double 11 (with the latest figures from last year’s Double 11)

- 9 hottest social media platforms: WeChat, Weibo, Douyin, RED, Bilibili, Zhihu, Kuaishou, Weitao, Toutiao

ChoZan report creators have interviewed over 50 experts from TV commentators and China’s tech giants in-house team to China agency owners, universities professors and established book authors to make sure the report is exhaustive and represents the collective wisdom of the China watchers. The mega report also gives pointers to 7 key China trends, 8 key consumption trends and 8 key marketing trends, making it the essential guidebook for success in 2021.

Key takeaways from the Q1 2021 China Marketing Report

- The economic value added to China’s digital economy reached 35.8 trillion RMB ($5.11 trillion USD) in 2019, accounting for 36.2% of GDP. By 2027, it is expected that the digital economy will account for about half of China’s GDP and become the main driver of the country’s economic growth. The digital economy is still in the early stages of growth, and will welcome a boom in the near future with China’s accelerating digital transformation.

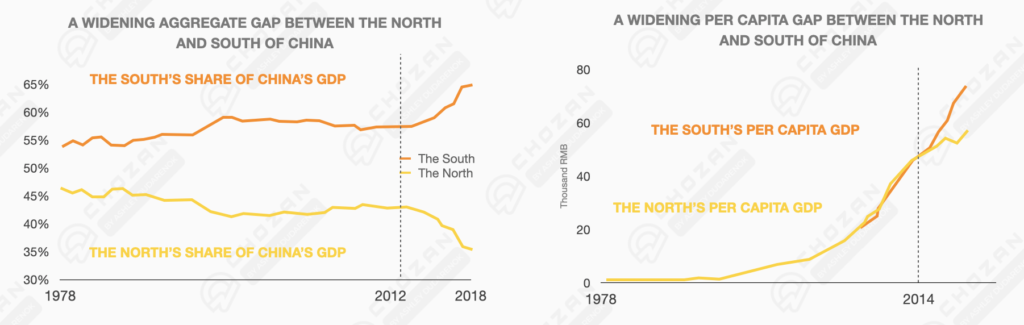

- We have seen extremely uneven economic recovery post COVID-19 between the south and north of China. The gap between the aggregate and per capita GDP is widening between the two – with the south of China advancing in both metrics. Southern and northern residents are showing very different mentality and consumption patterns after the pandemic. Southerners are generally less affected by the pandemic financially speaking, so they are already showing signs of revenge consumption after the pent up demand. People who reside in the north are harder hit by the economy and are more conservative with their spendings.

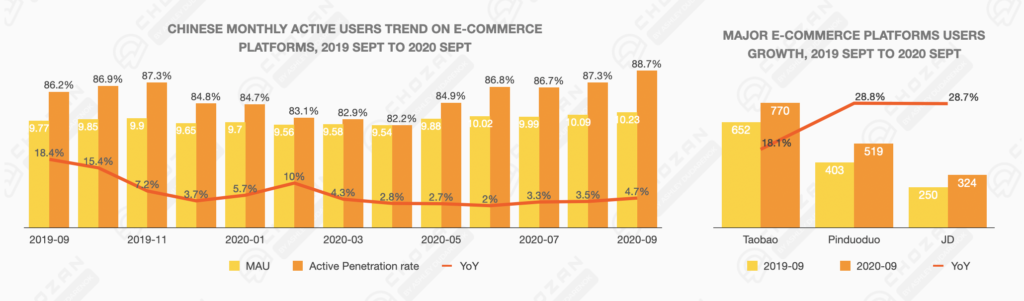

- 2020 has been a positive year for e-commerce. The number of monthly active users and active penetration rate across e-commerce platforms have both increased from September 2019 – 2020.

- With the Spring Festival, the biggest holiday of the year, just right around the corner, industry experts are confident and optimistic in Chinese netizens’ consumptions over this period. Consumers are likely to be more generous with their purchases as they spent the last Chinese New Year in the gloom cast by Covid. Experts also predict the food and beverage category and domestic tourism will soar in Q1 2021.

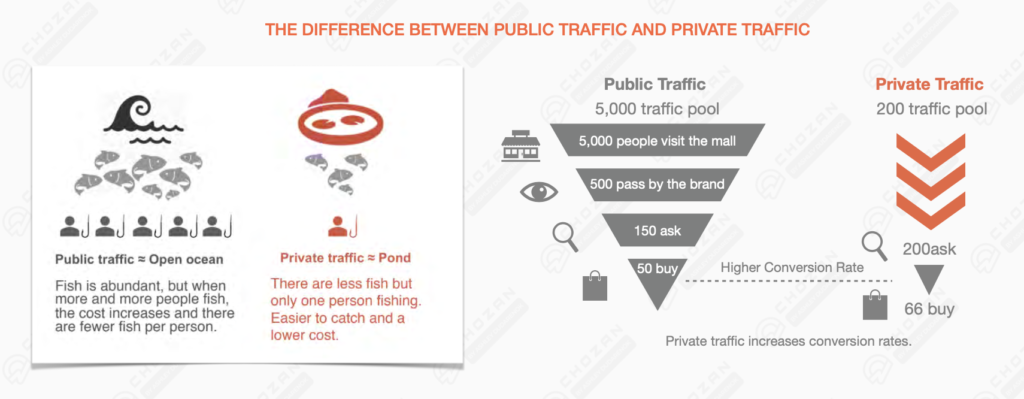

- Growing a private pool is key for businesses in 2021. Private traffic is great for businesses because it systematically reduces customer acquisition costs. With direct communication to customers, brands can also easily achieve higher conversion rates.

Apart from ChoZan insights, ChoZan report creators have interviewed over 50 experts from TV commentators and China’s tech giants in-house team to China agency owners, universities professors and established book authors to make sure the report is exhaustive and represents the collective wisdom of the China watchers. To gain the latest market and consumer information and the most actionable insights in 2021, download ChoZan’s Q1 2021 mega report right away.

Links to Alarice’s previously consumer-focused reports:

Super Moms and Dads

Pet Lovers