Over the last few years, Chinese beauty brands have been stealing share from the foreign players that have long dominated China’s cosmetic market. Although foreign brands still lead in the higher end of the market, middle and lower ranges have been impacted by some upstart Chinese brands.

The key drivers behind this are the Guochao trend favoring domestic brands, rising beauty awareness in lower-tier cities, attractive prices, constant product updates, canny co-branding, keenly timed limited editions and other innovative marketing approaches.

Domestic beauty brands like Perfect Diary and Florasis began mining key social marketing and sales channels earlier and in different ways than many foreign players. This experience allowed them to master new ways of reaching customers. Their low prices mean that they can sell high volumes to make the most of their margins. They also know how to repeatedly create explosively popular products that blow up quickly.

Let’s take a closer look at the essential elements for Chinese beauty brands marketing.

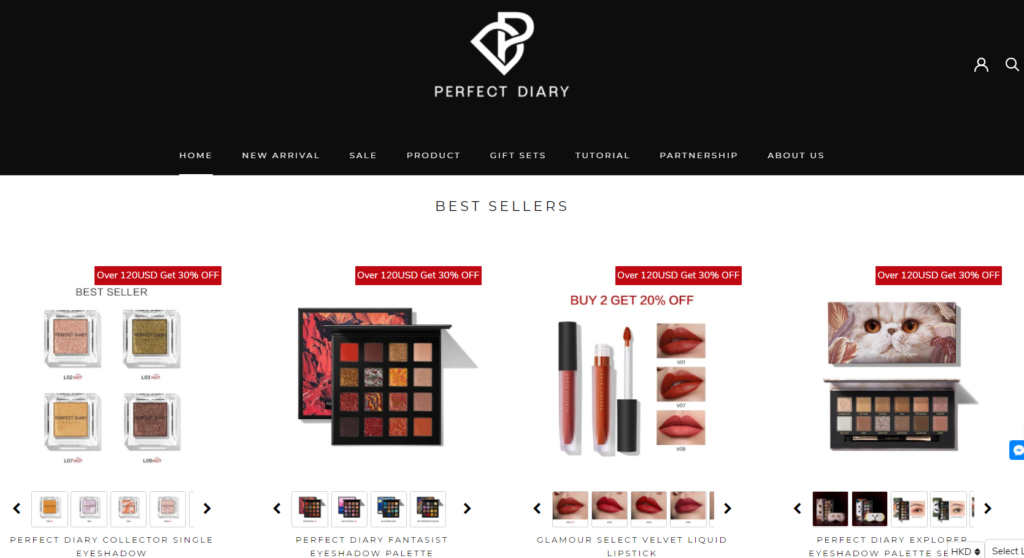

1. Pretty packaging and pricing

Perfect Diary knew how to make its packaging as attractive as an international brand’s at a reduced price. Some customers didn’t even realize that it was a Chinese brand when they first bought it. Being good value for money is one of the brand’s core selling points and Perfect Diary has also been disruptive by finding the ultimate price/performance ratio, using spaces and categories with misaligned competition.

2. Micro-innovations and accelerated product releases

Detailed micro-innovations in already segmented categories are one way these brands make products that break out. The tweaks usually fall into the categories of new design, new technology, new process, or a new scenario to meet the needs of current and new consumers. Examples of these kinds of breakout products include lightweight air lip glaze, sculpting lipsticks, bubble masks and mushroom head air cushion creams.

Brands like Perfect Diary also take a user-centric, data-driven approach to product development that means the speed of their new product launches is unparalleled.

3. Chinese elements and co-branding

Successful Chinese beauty brands established strong recognition quickly by co-branding with big names with strong visual impact that matches the image they’re trying to create. They got lots of traffic and seeded their name and products in the minds of potential purchasers.

Partnerships and adding meaningful Chinese elements have been crucial in their success. In its early stages, Perfect Diary launched products in association with fashion designers, such as Masha Ma, and did this during fashion week events to set the tone for the brand.

Then it did marketing campaigns that featured creative and cultural elements, including global ones like the Majolica pottery plates from the British Museum and animal themed palettes in partnership with the Discovery Channel, to enhance the brand’s core identity and expand its user base. At later stages, its products featured very popular brands and images that resonated with audiences, such as its eye shadow palette that featured Li Jiaqi’s dog Never.

4. Mastering the calendar

Chinese beauty brands intuitively understand the consumption cycles and marketing schedules that fit consumers and products best. The most important marketing times in China’s cosmetic industry fall into two categories: traditional festivals and e-commerce promotional festivals.

In 2019, May, June, September and November were the most important sales growth inflection points for domestic beauty brand Florasis. This matches the timings of major holidays and shopping festivals that are big for beauty brands. May is when 520 (May 20th, China’s Valentine’s Day) happens, June 18th is when the 618 online shopping festival is held, the Qixi Festival, another Chinese Valentine’s Day is in August and Alibaba’s Double 11 Shopping Festival is on November 11th.

5. Mobilizing different kinds of influencers

Chinese beauty brands are experts when it comes to which stars, influencers/KOLs (key opinion leaders), KOCs (key opinion consumers), and regular users to deploy and when. They do this to attract traffic in different layers of the audience, eventually building it into what seems like a ubiquitous recommendation craze.

Here’s one example of how it works.

In August, 2017, Florasis opened a flagship store on Tmall and posted a notice asking for “product experience officers” to participate in tests for six products. They posted the notice on their WeChat account and the home page of their Tmall flagship store. Thousands of users applied to test items before the launch creating buzz, FOMO, an event, conversations, sharing, anticipation and a huge potential customer base, all before the product had even been launched. Customers knew that they had played a part in the product’s creation and the brand got valuable feedback that helped it make improvements and target their customers’ immediate needs and wants.

When every other brand was busy jumping on the KOL bandwagon, Perfect Diary was one of the first to deploy KOCs on Red (Xiaohongshu) and WeChat. Ads and endorsements from celebrities and big KOLs to get public traffic are becoming more and more expensive while KOC content marketing reaches its audience directly and can be done at low cost. Perfect Diary was the first brand to perfect this new media marketing playbook and successfully create strong private traffic along the way.

6. Building private traffic

Perfect Diary’s private traffic is a large part of the reason why everyone pays attention to it and how it generates sales of more than 20 million yuan (source in Chinese) every month.

The brand retains its customers in WeChat groups and other places where it has fast, direct, private communication with them. These groups help them build closer relationships with consumers, collect more first-hand data, foster brand loyalty, and maintain higher sales. In 2020, Perfect Diary and its sister brands, Little Ondine and Abby’s Choice, had 23.5 million private domain customers.

A key part of Perfect Diary’s private traffic marketing strategy is virtual character Xiao Wanzi. WeChat is built around private links with friends and family but users can also follow official accounts run by brands, organizations and celebrities and receive messages from them. Unlike Facebook or Weibo, on WeChat ordinary users can’t make posts that are visible to the whole network. This is why Perfect Diary uses a virtual friend to make contact with the brand’s fans.

After purchasing products, customers get virtual red packets that they can only redeem after adding Xiao Wanzi as a friend. Once people add Xiao Wanzi as a friend through the brand’s official WeChat account, they can get a free product sample. There are hundreds of Xiao Wanzi accounts run by Perfect Diary employees with matching Moments posts and profile images. Another virtual character named Xiao Meizi helps respond to customer questions.

Each account runs dozens, if not hundreds, of WeChat groups full of customers.

The WeChat groups are moderated by “Xiao Wanzi” who gives access to exclusive offers, enables product previews, does customer relationship management, establishes or solidifies trends, starts discussions, facilitates advice exchange and shares inspiring images. But most importantly, this virtual moderator talks to group members about their lives, builds trust and creates a cohesive customer community.

7. Social media beyond WeChat and Weibo

Perfect Diary has set up an effective social media marketing matrix, including WeChat, Weibo, Red, Douyin and Bilibili with each platform having different positioning and employing different marketing strategies. For example, Weibo is for videos to consolidate the brand’s image and for celebrities to drive traffic. WeChat is for private traffic and CRM. Red is its main launch channel and Douyin attracts consumers.

Perfect Diary’s target consumer group is very much in line with Red’s audience. On Red, the brand cooperates with beauty bloggers who create content. This content is then used by Perfect Diary’s account. The official account has released more than 450 notes based on this kind of content.

Next steps: Expansion and moving offline

Chinese beauty brands seem to be following a path whereby they use online promotion to establish their brand and build sales, establish offline shops to consolidate their hold and then expand the brand overseas.

The brands seem to know that an online-only presence isn’t practical over the long term. One of the major disadvantages of this model is that sales can be very dependent on star livestreamers and promoters like Li Jiaqi and Viya. If they aren’t promoting a product, sales tend to fall off a cliff.

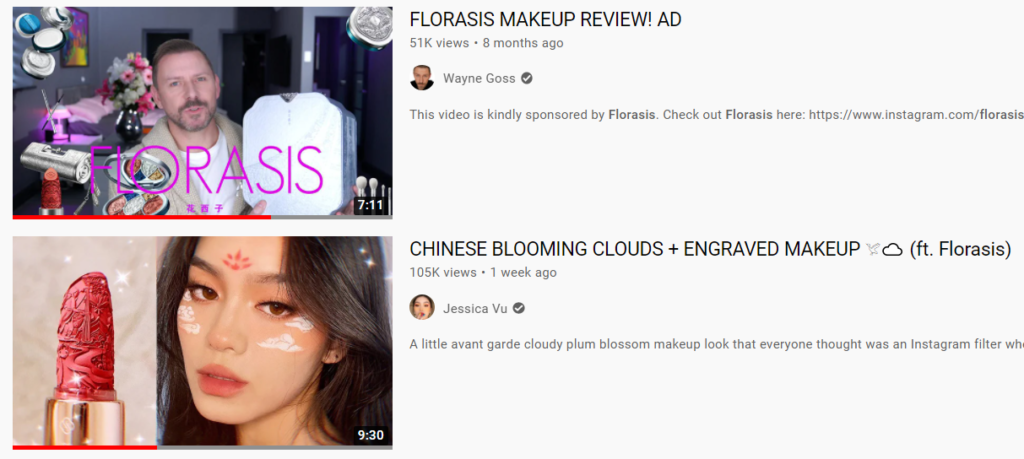

Perfect Diary and Florasis have already started moving into other markets, starting with Southeast Asian territories like Vietnam, Malaysia, Singapore, and the Philippines, and have promising sales there. Florasis is also somewhat known in the West. It’s active on Instagram and has gifted elaborate gift boxes to small and mid-sized Western makeup influencers on YouTube who have featured the brand in unboxing videos with flattering titles. However, it seems that it’s still hard to find their products in places like the U.S. or that customers outside of China can only buy products through the brand’s website.

Perfect Diary’s parent company Yatsen has started building physical stores and has a network of more than 200 locations. It’s also making acquisitions, including luxury skin care brands like Eve Lom and premium French skincare brand Galenic, that they think will do well in the Chinese market. The company also filed for an IPO on the New York Stock Exchange, raising more than $600 million.

These steps, along with an adjustment of their business model, are necessary. Their audience in China may have peaked and, in their extraordinary push for fast recognition and sales, their marketing and product development budgets are at unsustainable levels. For example, estimated net losses for Yatsen in the fourth quarter of 2020 were at 1.53 billion yuan ($234.7 million US).

A lot of brands learned from these upstarts and copied them, leading to fierce competition. Now, these brands need to transform themselves and build a stable, solid foundation for the plans they have in mind.

If you need an agency that deeply understands social media marketing in China and conducts detailed Chinese marketing strategy that fits your brand, we can help.

And if you have urgent questions or want to learn more from or about Chinese brands or the China market in general, ChoZan’s consultation services and expert calls are your shortcut to expertise.

Contact us with any questions you might have and we’ll put you on the right track.